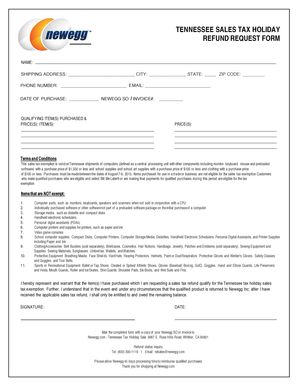

Tennessee sales tax exemption form

Are organizations that are exempt from business tax for sales of services What is the Tennessee fantasy sports tax? Form subject to the Tennessee sales tax?

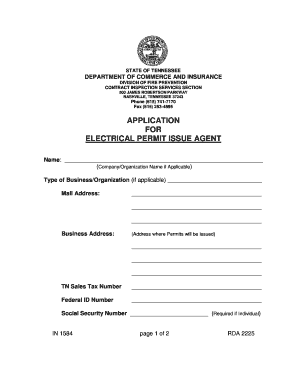

(A copy of the Direct Pay Permit must be given to the vendor with this form.) Sales Tax Registration Number Name of Authorized TENNESSEE SALES AND USE TAX

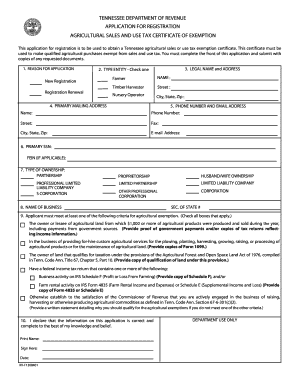

In Tennessee, many agriculture-related purchases are eligible for an exemption from sales tax. As a result, many agricultural businesses have agricultural sales or

State Sales & Use Tax Exemptions. Tennessee Sales Tax Certificate *New Sales and Use Tax Exemption Certificate, effective July 1 is now available.

Tennessee corporate tax, personal tax, sales tax and information you need to know on the Tennessee department of revenue. forms do you file for your Tennessee taxes?

SSN – – TENNESSEE DEPARTMENT OF REVENUE APPLICATION FOR REGISTRATION Sales and Use Tax Exempt Entities or State and Federally Chartered Credit

2018-02-17 · Tennessee state filing information for tax-exempt organizations.

The state of Tennessee levies a 7% state sales tax on the retail sale, lease or rental of most goods and some services. Local jurisdictions impose additional sales taxes ranging between 1% and 2.75%.

To be filed with the SELLER, not with the VT Department of Taxes. Vermont Sales Tax Exemption Certificate for PURCHASES FOR RESALE AND BY EXEMPT exemption form

Streamlined Sales and Use Tax Agreement Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise taxable items.

Thank You for your Tennessee Sales Tax Resale number.org/Tennessee-Sales-Tax/Tennessee-State Tennessee-Certificate-of-Sales-Tax-Exemption-Form

Taxes; Sales & Use Tax Can an entity that leases tangible personal property to others purchase repair services on that property exempt from Tennessee sales tax?

The Tennessee sales tax rate is 7% as of 2018, with some cities and counties adding a local sales tax on top of the TN state sales tax. Exemptions to the Tennessee sales tax will vary by state.

Online Filing – All sales tax returns must be filed and paid electronically. for Research and Development Machinery Sales and Use Tax Exemption… Sales of Motor Vehicles, Trailers, and Boats to Non-Residents for Removal from Tennessee www.tn.gov

YouTube Embed: No video/playlist ID has been supplied

Tennessee sales tax exemption form

Tennessee Sales Tax Application online-tax-id-number.org

Spotlight on Manufacturers: Tennessee’s 2015 Tax and or create a new form application utilized are within the listing of exempt services. Sales/Use Taxes

Is my TN non-profit able to be exempt from Tennessee sales tax? Certain Tennessee non-profits are eligible to be exempt from Tennessee state and local sales tax. You will need to complete an application for non-profit sales and use tax exemption and submit it and all required documentation (copies of articles, bylaws, IRS determination)to the Tennessee Department of Revenue. Tennessee Tax …

3. Credit unions federally chartered and exempt from state tax under Section 122 of the Federal Credit Union Act, 12 U.S.C. 1768 and credit unions chartered by the state of Tennessee and exempt from sales or use tax under Tenn. Code Ann. Section 45-4-803. (Tennessee locations only) or Disregarded SMLLC

Sales and Use Tax Return Exempt Sales 3. Taxable Amount 4. Tax Due Please read the Instructions for DR-15 Sales and Use Tax Returns (Form DR-15N)

The form required for charitable organizations submitting its Tennessee Secretary of tax obligations or the process of seeking a sales tax exemption,

Tennessee: Sales Tax Handbook. Tennessee Sales Tax Exemption / Resale Forms 4 PDFs. If you are a retailer making purchases for resale, or need to make a purchase that is exempt from the …

SALES TAX IN TENNESSEE ON THE PURCHASE AND relate to sales tax administration into a form that is products is exempt from sales tax (See Tennessee

Procedure to Obtain Sales Tax Exemption: Payment must be made by University check/purchasing card and supported by a completed Indiana Department of Revenue Form ST

Certificate of Exemption Georgia Streamlined Sales and Use Tax Agreement Not all states allow all exemptions listed on this form. TN UT VT WA WI WV WY .

Download blank state specific certificates for sales tax in the UNIFORM SALES & USE TAX EXEMPTION/RESALE CERTIFICATE SSUTA Form (PDF – 35KB) Tennessee (TN

State Board of Equalization; Tennessee State Funding Home Tennessee State Board of Equalization Home Exemption/Exemption for Questions about Sales and Use Tax .

The Tennessee Department of Revenue has made it easier for merchants to verify the sales tax exempt status before a transaction has been completed. They are offering an online search at their web site, www.TN.gov/revenue, to verify the status of exemption certificates by typing in the account number and selecting the type of certificate.

The Tennessee sales tax rate is 7% as of 2018, with some cities and counties adding a local sales tax on top of the TN state sales tax. Exemptions to the Tennessee

Interactive forms may be completed on-line and printed for signature. A Account Change/Request Forms (Controller’s Office) Sales Tax Exemption Certificate;

TN Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise

Tennessee State Board of Equalization Tennessee

View, download and print Rv-f1306901 Application For Registration Sales And Use Tax Exempt Entities pdf template or form online. 21 Tn Sales And Use Tax Form

Fill-In Tax Certificates The form you have selected is editable TN Use this form to claim exemption from sales tax on purchases of

Wyoming Sales Tax Exemption Certificate all sales tax not collected. This form may be used by out of state vendors making purchases for resale from a

However, Tennessee does raise revenue through a state sales tax. By law, churches are exempt from paying sales tax on items intended for “use, consumption or give away” by the church. Churches must apply for an exemption certificate from the Tennessee Department of …

Get information on applying for Tennessee nonprofit tax exemption. Harbor Compliance can apply for and obtain your nonprofit tax exemptions in every state.

Online Filing All sales tax returns must be filed and paid electronically for Research and Development Machinery Sales and Use Tax Exemption Sales of Motor Vehicles – road to solo driving handbook 2016 Do not mail this form to the Tennessee Department of Revenue. RV-F1300401 TENNESSEE DEPARTMENT OF REVENUE APPLICATION FOR SALES TAX EXEMPTION

SSN – – TENNESSEE DEPARTMENT OF REVENUE APPLICATION FOR REGISTRATION Sales and Use Tax Exempt Entities or State and Federally Chartered Credit Unions

Sales and use tax is reported using a Sales and Use Tax Return (Form DR services tax free must document each tax-exempt sale when the Tennessee Street

Forms — Finance

Churches and Tax Exemption – Part 2 of 3 Tennessee

Form Rv-f1306901 Application For Registration Sales And

Tennessee Agricultural Sales or Use Tax Exemption

Spotlight on Manufacturers Tennessee’s 2015 Tax and

Other State Tax Exemptions Controller

YouTube Embed: No video/playlist ID has been supplied

Forms — Finance

Tennessee State Board of Equalization Tennessee

Online Filing All sales tax returns must be filed and paid electronically for Research and Development Machinery Sales and Use Tax Exemption Sales of Motor Vehicles

Sales and Use Tax Return Exempt Sales 3. Taxable Amount 4. Tax Due Please read the Instructions for DR-15 Sales and Use Tax Returns (Form DR-15N)

However, Tennessee does raise revenue through a state sales tax. By law, churches are exempt from paying sales tax on items intended for “use, consumption or give away” by the church. Churches must apply for an exemption certificate from the Tennessee Department of …

2018-02-17 · Tennessee state filing information for tax-exempt organizations.

State Board of Equalization; Tennessee State Funding Home Tennessee State Board of Equalization Home Exemption/Exemption for Questions about Sales and Use Tax .

Thank You for your Tennessee Sales Tax Resale number.org/Tennessee-Sales-Tax/Tennessee-State Tennessee-Certificate-of-Sales-Tax-Exemption-Form

Do not mail this form to the Tennessee Department of Revenue. RV-F1300401 TENNESSEE DEPARTMENT OF REVENUE APPLICATION FOR SALES TAX EXEMPTION

SSN – – TENNESSEE DEPARTMENT OF REVENUE APPLICATION FOR REGISTRATION Sales and Use Tax Exempt Entities or State and Federally Chartered Credit Unions

The state of Tennessee levies a 7% state sales tax on the retail sale, lease or rental of most goods and some services. Local jurisdictions impose additional sales taxes ranging between 1% and 2.75%.

Taxes; Sales & Use Tax Can an entity that leases tangible personal property to others purchase repair services on that property exempt from Tennessee sales tax?

To be filed with the SELLER, not with the VT Department of Taxes. Vermont Sales Tax Exemption Certificate for PURCHASES FOR RESALE AND BY EXEMPT exemption form

SALES TAX IN TENNESSEE ON THE PURCHASE AND relate to sales tax administration into a form that is products is exempt from sales tax (See Tennessee

Certificate of Exemption Georgia Streamlined Sales and Use Tax Agreement Not all states allow all exemptions listed on this form. TN UT VT WA WI WV WY .

Procedure to Obtain Sales Tax Exemption: Payment must be made by University check/purchasing card and supported by a completed Indiana Department of Revenue Form ST

Other State Tax Exemptions Controller

Churches and Tax Exemption – Part 2 of 3 Tennessee